Your Roadmap to Prosperity & Peace of Mind

Get your affairs in order now with personalized financial wellness, life transitions, or end-of-life planning.

Project UP is your trusted partner for holistic life planning. Empowering you to master your finances, navigate life’s transitions, and leave a meaningful legacy. Achieve the future you desire and end well.

Our Services

Welcome to Project UP, where we weave together the cords of your life’s journey with our comprehensive suite of financial, transitional, legacy, and life planning services. With a compassionate and proactive approach, we guide you through the various milestones and challenges that life presents, providing support as you navigate both the expected and unexpected moments. Our mission is to empower you to create a secure and fulfilling future, enabling you to cherish every moment with confidence and peace of mind and to leave behind a secure legacy you are proud of.

- Cash Flow Assessment

- Net Worth Analysis

- Budget Development

- Debt Analysis

- Savings Planning

- Financial Goal Setting

- Tax Efficient Strategies

- “What If” Scenarios

- Financial “Levers”

- Funding Strategies For Goals

Life Transitions

Help me through a tough time, achieve an exciting goal or take the next step.

- Early Retirement

- Divorce Or Separation

- Travel Goals

- Terminal Diagnosis

- Growing Family Considerations

- Relocation Or Downsizing

- Elder Care

- Insurance Protection

- Education Savings

- Job Promotion or Loss

Before & After Loss

Help me plan my final details & wishes or manage those of a loved one.

- Wills & Trusts Checklist

- Estate Administration

- Legacy Planning

- Beneficiary Guidance

- Affordability Of Care Options

- Property Distribution Support

- Details Of Daily Living

- Tax Direction

- Funeral Arrangements

- Account Ownership & Closures

Life Wrap

Help me increase my prosperity today and plan for my legacy tomorrow.

- Holistic Review Of Your Life Now & Later

- All Relevant Services For Your Unique Situation Included

- Financial Wellness

- Life Transitions

- Before & After Loss

- Coordinate Advisory Team

- Annual Review & Update

- Your Personalized Life Roadmap

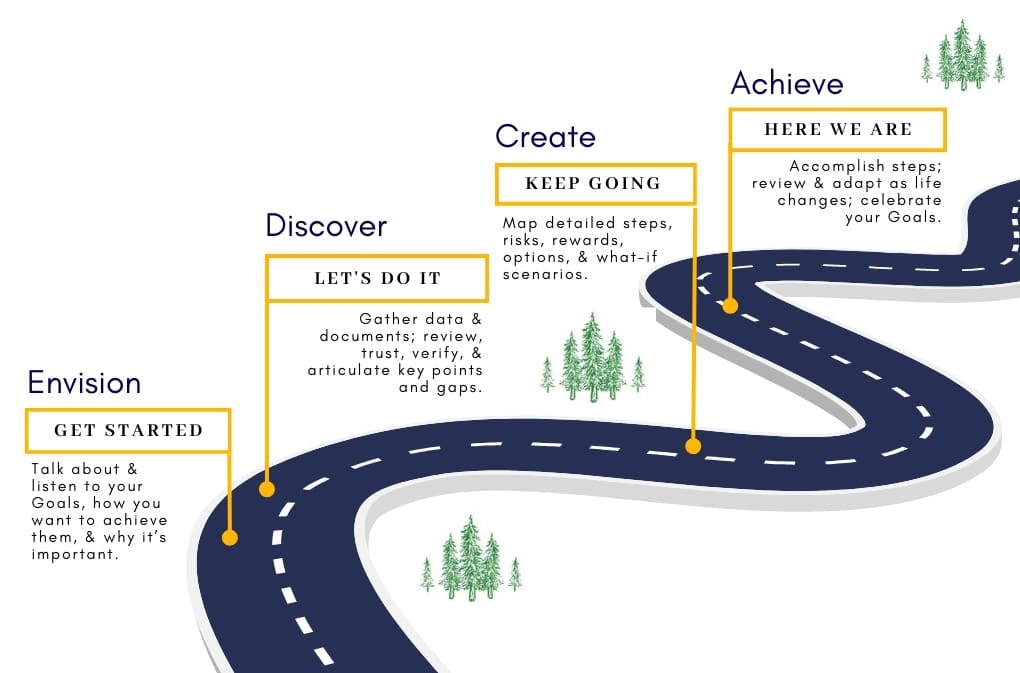

Our Process

The steps may be similar, but the timing and details are all you, uniquely YOU.

From wishing to achieving. Personalized.

Death Binder Checklist

How do you create a useful roadmap for your final wishes and make it fun? Download this valuable free checklist today.

Starting Out Checklist

Are you starting your financial journey? Download this valuable free checklist today.

2023 - 2024 Key Numbers

Do you know what the “numbers” are for tax planning, Social Security, retirement planning, Medicare, and more? Download this valuable 30-page free report today.

Resources

From wishing to achieving. Unlock the power of knowledge and preparation with our invaluable financial wellness, life transitions, and end of life resources.

Explore these essential resources today, and take the first step toward securing your financial future, achieving your goals during life’s transitions, and peace of mind in end-of-life planning. Your path to a more confident and prepared tomorrow starts here.

Your Life Today. Your Legacy Tomorrow.

Frequently Asked Questions

How does your work differ from a certified financial planner?

We help answer the burning question: “How much is enough?” To retire, to go on vacation, to care for elderly parents, etc.

We help our clients take control of their cash flow and net worth to meet their life goals, such as early retirement, large purchases, planning for eldercare, or just peace of mind. We take a broader view of assets and liabilities than many certified financial planners, and we work with clients in greater detail. For instance, we show a year-by-year analysis of how your sources of net income fall short, meet, or exceed your financial questions and goals.

Although we are not currently certified financial planners and do not invest your money, our model and process have helped many people feel more confident about what, how, and when they grow, maintain, and pull specific financial levers. In addition, we help prepare a personalized financial portfolio and roadmap to guide the person who needs to assume the financial responsibilities on behalf of an incapacitated or deceased person.

In some circumstances, we participate in discussions with clients and their other trusted advisors. We help as another listening ear, to articulate and advocate for the client’s wishes, to highlight potential gaps, and to help ensure the client’s goals are being holistically met. We do not charge a fee during this consultation, so that the client is not charged for both professionals during these meetings.

Why can’t I use an on-line income calculator?

Often these apps are not personalized, and may just be general rules of thumb or ballpark estimates designed for very general guidance. Every forecast or projection we do is personalized to you – value of your home, value of your specific income/assets, your tax bracket, state you live in, RMD (Required Minimum Distribution), etc. We show a detailed, personalized year by year analysis as opposed to a generalized percentage of whether you will outlive your assets.

What if I already have 1 or more trusted advisors, like a CPA, attorney, or family member?

Project UP works with your existing trusted advisors. We do not seek to replace your existing network; rather, we strive to enhance it by bringing expertise, coordination, and integration to a complex set of facts and issues.

In some circumstances, we participate in discussions with clients and their other trusted advisors. We help as another listening ear, to articulate and advocate for the client’s wishes, to highlight potential gaps, and to help ensure the client’s goals are being holistically met. We do not charge a fee during this consultation, so that the client is not charged for both professionals during these meetings.

This seems like a lot of work. Do I have to do it all at once?

Project UP supports you wherever you are in your journey. Our team is skilled and experienced, and our process is designed to help you take small, but meaningful steps. For most clients, this is an iterative process with many building blocks. We can create a plan that is right for you right now. And when circumstances change, Project UP will be there to support you.

I can see the value in Project UP, but I want to take action on my own. Can I do that?

Project UP supports you wherever you are in your journey. We can create a plan that you complete on your own. We will be here if you have questions or need additional support.

I only need one thing – like better understanding about when I can retire or help moving a parent. Can you do that?

Yes! Project UP supports you wherever you are in your journey. We can complete individual tasks for you or resolve a specific issue. However, our experience has proven that a holistic view provides the optimum benefits and outcomes, so we will highlight additional issues for you as they come up. You decide when the timing is right to take action. Project UP will be ready to support you.

What if I just need a will?

Project UP can help you organize your goals for end-of-life planning and help find an attorney to create your will. Project UP is not a law firm and cannot write your will, power of attorney, or other legal documents in an estate plan. However, we can help you be more prepared and focused when you do talk with an attorney by helping you articulate and create a planning checklist that you and your attorney may use in the creation of the legal documents needed for estate planning.

In some circumstances, we participate in discussions with clients and their other trusted advisors. We help as another listening ear, to articulate and advocate for the client’s wishes, to highlight potential gaps, and to help ensure the client’s goals are being holistically met. We do not charge a fee during this consultation, so that the client is not charged for both professionals during these meetings.

I already have a will and an investment advisor. Why would it benefit me to work with Project UP?

Our experience shows that everyone hopes and believes that their financial wellness is maximized and their legacy and estate plans are in order. However, once you start verifying the data, process, beneficiaries, etc., something is usually out of order and not in line with how the person wanted it to work. This happens for many reasons, such as, trusted advisors being siloed from each other and life changes that impact personal decisions.

Financial planning and legacy planning change as life changes and should be reviewed regularly. Project UP can help you identify opportunities and roadblocks and confirm that your plans are going to be implemented as you want.

In some circumstances, we participate in discussions with clients and their other trusted advisors. We help as another listening ear, to articulate and advocate for the client’s wishes, to highlight potential gaps, and to help ensure the client’s goals are being holistically met. We do not charge a fee during this consultation, so that the client is not charged for both professionals during these meetings.

Why should I do any of this now? I am, and we are, in good health and doing just fine.

When you intentionally plan for the future, you are more likely to meet your goals. You will also be able to navigate the unknown changes in life more confidently and securely.

Financial wellness does not happen without engagement from you. Active financial planning will help you meet your financial goals and make your retirement plan become less of a wish and more of a reality.

Estate and advance care planning is a gift to yourself and to your friends and family. You free the people you love most from the burden of making difficult decisions in a difficult time.

Years ago I told my family what I wanted. Will they do as I asked?

Hopefully, family will do exactly as you asked them for your end of life care. However, what if your wishes changed, or what if your family remembers things differently or changes how they feel about implementing your wishes? Maybe you wanted a spouse to make financial decisions for you, but you divorced, or now your child is a successful banker. Maybe in the past you wanted “everything possible” to help in a time of crisis, but that was before you imagined, or actually saw, the personal impact of what “everything possible” entails. Maybe a friend living in a nursing home seems much happier than you thought, and now that seems like an interesting option for you. If your wishes changed, would your loved ones know that? Do you want to leave those important decisions to chance?

Start Today.

Your Life Today. Your Legacy Tomorrow.