Introduction

Financial confidence, financial wellness, and financial literacy in managing your personal finances are essential aspects of a fulfilling life. In today’s complex financial landscape, where personal finance decisions can significantly impact your future, understanding and mastering these concepts is more critical than ever. Whether you’re just starting your financial journey or looking to enhance your knowledge, this article is designed to guide you towards personal financial confidence and control. If you want financial empowerment and peace of mind, continue reading to build your financial knowledge and your financial wellness.

The Foundations of Financial Confidence

Financial confidence is the belief in your ability to make sound financial decisions and manage your money effectively. It’s rooted in financial knowledge, skills, and the application of good financial habits.

The link between financial knowledge and financial confidence is strong. Knowledge of financial literacy skills are key to building confidence in managing personal finances. Confidence grows as you gain a better understanding of financial products and concepts through building good financial habits.

Good money habits start with a better understanding of some relatively simple actions. The following examples illustrate how cultivating good financial habits and making sound financial decisions can contribute to financial confidence and long-term financial well-being.

Good Financial Habits:

- Regularly Saving and Investing: Cultivating a habit of saving a portion of your income and consistently investing it is a crucial financial habit. This habit allows you to build wealth over time, take advantage of compound interest, and achieve your long-term financial goals, such as retirement or purchasing a home.

- Creating and Following a Budget: Maintaining a budget is another essential financial habit. It involves tracking your income and expenses, categorizing spending, and adhering to a spending plan. By budgeting, you can ensure you live within your means, avoid unnecessary debt, and allocate funds towards your financial priorities.

Sound Financial Decisions:

- Paying Off High-Interest Debt: A sound financial decision is to prioritize paying off high-interest debt, such as credit card balances, as quickly as possible. High-interest debt can accumulate quickly and become a significant financial burden. By paying it off, you save money on interest and free up funds for saving and investing.

- Diversifying Investments: Making informed investment decisions is essential for building wealth. A sound financial decision is to diversify your investment portfolio by spreading your investments across different asset classes, such as stocks, bonds, and real estate. Diversification helps reduce risk and increase the potential for long-term returns.

Financial Wellness & Financial Literacy – Two Steps on the Road to Financial Freedom

Financial wellness is the state of having a healthy relationship with your personal finances. It’s about achieving financial security, peace of mind, and well-being through informed and responsible financial decisions.

Financial literacy refers to the knowledge and skills necessary to make informed and effective financial decisions. It involves understanding basic financial concepts, principles of financial planning, and the ability to manage personal finances effectively.

Financial literacy supports financial wellness. Financial wellness impacts overall well-being, reducing stress levels and promoting mental health. It allows you to feel confident in your financial life and make informed decisions about your personal finances. Achieving financial wellness sets the foundation for financial confidence, and in turn your financial freedom and a secure economic life.

10 Steps to Creating Your Financial Wellness Plan

1. Assess Your Financial Wellness Situation:

To assess your financial wellness, compile a comprehensive list of your income sources, monthly expenses, outstanding debts, and assets. This snapshot will give you a clear picture of your financial health. Regularly revisiting and updating this assessment helps you track your progress and make informed decisions about your finances. Below are examples of income sources, monthly expenses, outstanding debts, and assets.

Income Sources:

- Rental Income: If you own a property and receive rental payments from tenants, this is considered rental income.

- Side Gig Earnings: Income earned from freelance work, a part-time job, or a side business venture, such as selling handmade crafts online.

- Royalties: If you’ve authored a book, created music, or have intellectual property, royalties from the sales of your work can be a source of income.

Monthly Expenses:

- Subscription Services: Regular monthly expenses may include subscription services like streaming platforms (e.g., Netflix or Spotify), gym memberships, or subscription boxes.

- Childcare Costs: If you have children, monthly expenses could include daycare fees or after-school programs.

- Home Maintenance: Budgeting for ongoing home maintenance costs, such as lawn care, pest control, and repairs, is crucial to ensure your property remains in good condition.

Outstanding Debts:

- Student Loans: If you financed your education through loans, you may have outstanding student loan debt that requires monthly payments.

- Medical Bills: Unpaid medical bills from a past medical procedure or illness can be considered outstanding debt.

- Credit Card Balance: A credit card balance, especially if it carries a high interest rate, is a common form of outstanding debt that needs to be managed.

Assets:

- Investment Portfolio: Your investment portfolio, including stocks, bonds, and mutual funds, represents financial assets that can appreciate over time.

- Real Estate: If you own property, such as your primary residence or rental property, the market value of these properties is considered an asset.

- Savings Accounts: Funds held in savings accounts, certificates of deposit (CDs), or money market accounts are considered liquid assets that can be accessed for various purposes.

These examples provide a variety of income sources, expenses, outstanding debts, and assets that individuals may encounter when assessing their financial wellness. Learning more about each of these will also increase your financial literacy skills.

Get Your Free Financial Starting Out ChecklistGet Your Free Financial Starting Out Checklist2. Set SMART Financial Goals:

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. When setting financial goals, be clear about what you want to achieve, set measurable targets, ensure they are realistic within your current financial situation, align them with your values and priorities, and establish a timeline for achieving them. These goals provide a roadmap for your financial wellness journey.

Here are two examples of SMART financial goals:

Example 1: Retirement Savings Goal

- Specific: I want to save $500,000 for my retirement.

- Measurable: I will track my progress by reviewing my retirement account statements regularly.

- Achievable: I reviewed my current income and expected rate of return on investments, and given the numbers, this goal is realistic.

- Relevant: Saving for retirement aligns with my long-term financial security and future well-being.

- Time-bound: I aim to achieve this goal in 20 years, which means saving approximately $1,667 per month to reach my target.

Example 2: Emergency Fund Goal

- Specific: I want to establish an emergency fund with three months’ worth of living expenses.

- Measurable: I will monitor my progress by tracking my savings account balance.

- Achievable: Based on my current monthly expenses and income, saving for this emergency fund is achievable.

- Relevant: Having an emergency fund will provide financial security and peace of mind in case unexpected expenses arise.

- Time-bound: I aim to achieve this goal within 12 months by consistently saving a portion of my income until I reach the desired amount.

These SMART financial goals are clear, measurable, achievable, relevant to the individual’s financial well-being, and have specific timelines for achievement. They provide a structured roadmap for financial planning and help individuals stay focused on their objectives.

3. Create a Budget:

Building a budget is about more than just tracking expenses; it’s a fundamental financial literacy tool for personal financial management. It helps you plan and allocate your income effectively. Start by categorizing your expenses and comparing them to your income. Identify areas where you can cut back or reallocate funds towards your goals. Regularly review your budget to stay on track and adjust as your financial situation evolves. Think about hidden expenses too. Below are examples of common expenses and hidden expenses that individuals should consider when listing and tracking their expenses:

Common Expenses:

a. Utilities: Monthly expenses like electricity, gas, water, and internet bills are essential and easily overlooked when listing expenses.

b. Rent or Mortgage Payments: The cost of housing, whether you’re renting or paying a mortgage, is one of the most significant regular expenses for many individuals or families.

c. Groceries: Grocery shopping is a common recurring expense, and it’s essential to include it in your budget planning.

d. Transportation: Expenses related to commuting, such as fuel, public transportation fares, or car maintenance, should be tracked, as they can consume a significant portion of your budget.

e. Insurance Premiums: Regular insurance payments, including health, auto, home, or life insurance, are expenses that ensure your financial security and should be accounted for in your budget.

Hidden Expenses:

f. Subscription Services: Overlooked or forgotten subscription services, such as streaming platforms, magazine subscriptions, or monthly app subscriptions, can add up significantly over time.

g. Bank Fees: Some bank accounts charge monthly maintenance fees, ATM withdrawal fees, or overdraft fees. These fees can accumulate if not closely monitored.

h. Automatic Renewals: Subscriptions or memberships that automatically renew, such as gym memberships, software licenses, or annual website domain fees, may catch you by surprise if you’re not aware of their renewal dates.

i. Impulse Purchases: Small, unplanned purchases like daily coffee runs, snacks, or impulse buys while shopping can collectively amount to a substantial expense over a month or year.

j. Interest on Credit Cards: If you carry a balance on your credit card, the interest charges can be a hidden expense that grows over time, especially if you’re only making minimum payments.

These examples showcase the importance of listing and tracking both hidden and common expenses to gain a comprehensive understanding of your spending habits and make informed financial decisions. As your financial literacy grows, you will see more clearly the positive and negative consequences of your financial decisions in your monthly budget.

4. Manage and Reduce Debt:

Debt is when you borrow money from someone or from an institution like a bank, and you promise to pay it back later, usually with an extra amount called interest. Simply stated, debt is something you owe, like card cards, auto loans, and mortgages. Your financial wellness does not depend on eliminating all debt. However, high-interest debt and lots of debt can impact your credit score and be significant obstacles to financial wellness. One strategy is to prioritize paying off debts with the highest interest rates while making minimum payments on others. As you reduce your debt burden, you’ll free up more money for your retirement savings plan and investing, putting you on a path to financial freedom.

Examples of Common Debt:

- Student Loans: Money you borrow to pay for college that you need to repay after you graduate.

- Credit Card Balances: When you use a credit card to buy things and then need to pay back the credit card company.

- Mortgages: A loan you take to buy a house, and you pay it back over many years.

Rules for Paying Off Debt:

- Pay the Highest Interest Rate First: If you have multiple debts, focus on paying off the one with the highest interest rate first, as it’s costing you the most money over time.

- Make Consistent Payments: Always make at least the minimum payments on all your debts to avoid penalties and late fees.

- Create a Budget: Make a budget to track your expenses and find extra money to put towards paying off your debts faster.

5. Build an Emergency Fund:

An emergency fund is your financial safety net. The rule of thumb is to aim to save three to six months’ worth of living expenses in a separate, easily accessible account. This emergency savings fund provides peace of mind during unexpected financial challenges, ensuring you don’t need to rely on credit or deplete your regular savings in times of crisis.

Creating an emergency fund is part of your financial wellness plan. Choosing the best type of emergency fund account is an example of financial literacy. An emergency fund account does not exclusively need to be a savings account. It could be a brokerage account or other types of accounts. Try to find a place where your money is working for you – where you get some interest paid to you.

There are several types of accounts that are separate and easily accessible for putting 3-6 months of living expenses into, each with its own set of considerations:

-

High-Yield Savings Account: A high-yield savings account is a popular choice for an emergency fund. It offers a higher interest rate than a regular savings account, allowing your money to grow while remaining easily accessible. These accounts are typically offered by online banks and have no or low minimum balance requirements.

-

Money Market Account: Money market accounts are similar to savings accounts but may offer slightly higher interest rates. They often come with check-writing privileges and debit cards, providing easy access to your funds in case of emergencies.

-

Certificates of Deposit (CDs): CDs are time deposits with fixed interest rates and maturity dates. While they offer higher interest rates than regular savings accounts, your money is locked in for a specific period, such as 3 months, 6 months, or longer. Breaking a CD before maturity may result in penalties, so consider your liquidity needs carefully.

-

Online Checking Accounts: Some online banks offer high-yield checking accounts with competitive interest rates. These accounts often provide the convenience of a traditional checking account while also allowing your money to earn interest.

-

Emergency Fund or Rainy-Day Account: Some financial institutions offer specialized accounts explicitly designed for emergency funds or rainy-day savings. These accounts may come with features like fee waivers and overdraft protection.

-

Taxable Brokerage Account: While not traditionally considered an emergency fund account, a taxable brokerage account can be an option if you want to invest your emergency fund in a mix of stocks and bonds to potentially earn higher returns. However, keep in mind that the value of investments can fluctuate, and it may take longer to access your funds compared to a savings or checking account.

When choosing an account for your emergency fund, consider factors like liquidity, ease of access, safety, and the interest rate offered. It’s essential to strike a balance between accessibility and yield to ensure your emergency fund is readily available when needed while also working to grow your money over time.

6. Start Investing:

Investing is a crucial step in building long-term wealth. Research different investment options and consider diversifying your portfolio. Remember that investing carries risks, so it’s essential to understand your risk tolerance and invest in alignment with your financial goals.

Some basic financial literacy principles of investment include understanding different investment vehicles, including stocks, bonds, real estate, and mutual funds. Another critical financial literacy principle is the power of compound interest. The power of compound interest to grow your wealth over time is an example of a simple idea with an enormous benefit.

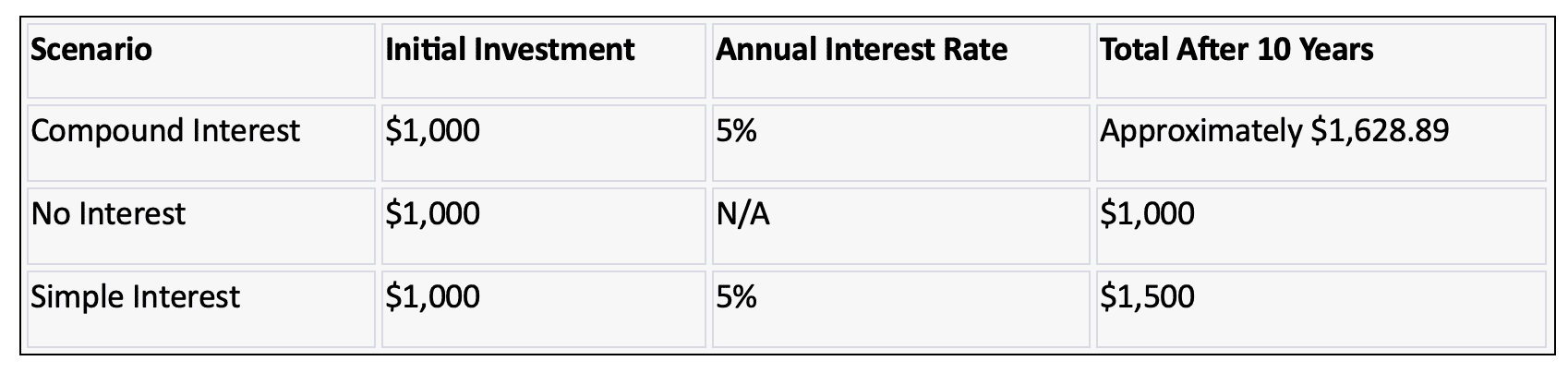

Let’s compare three scenarios: compound interest, no interest, and simple interest over 10 years. We’ll use an initial investment of $1,000 and an annual interest rate of 5% for the interest scenarios.

Compound Interest:

- Initial Investment: $1,000

- Annual Interest Rate: 5%

- Total After 10 Years: Approximately $1,628.89

No Interest:

- Initial Investment: $1,000

- No additional interest added.

- Total After 10 Years: $1,000 (no change)

Simple Interest:

- Initial Investment: $1,000

- Annual Interest Rate: 5%

- Total Interest Earned Over 10 Years: $1,000 × 0.05 × 10 = $500

- Total After 10 Years: $1,000 (initial investment) + $500 (simple interest) = $1,500

Here’s a comparison table of the three scenarios:

As you can see from the table, compound interest significantly outperforms both no interest and simple interest over a 10-year period. While simple interest adds a fixed amount each year, compound interest allows your money to grow exponentially, resulting in substantially more significant gains over time. Compound interest is a powerful tool to help you build wealth and achieve long-term financial goals. Consider what your return would be on $10,000 or $100,000 or more.

Tips for getting started with investing

- Create a Diversified Portfolio: Diversification is a key strategy for managing risk in your investment portfolio. Avoid putting all your money into a single investment or asset class. Instead, spread your investments across different types of assets to reduce the impact of a poor-performing investment on your overall portfolio. Diversification can help balance risk and potentially improve returns.

- Start Small and Consistent: You don’t need a large sum of money to start investing. Many brokerage platforms offer low or no minimum investment requirements. Begin by investing a small amount regularly, such as a fixed monthly contribution. Consistency in investing, even with modest amounts, can lead to significant growth over time, thanks to the power of compounding.

- Understand Risk and Time Horizon: Assess your risk tolerance, which is your comfort level with the possibility of investment fluctuations. Consider your investment time horizon, which is the length of time you plan to hold your investments before needing the money. Generally, longer time horizons allow for a higher tolerance for risk. Align your investment choices with your risk tolerance and time horizon to create a strategy that matches your financial objectives.

If you do even a little reading about investing, you will see a common statement that investing involves risk, and there are no guarantees of returns. This statement should be a part of your financial literacy and financial wellness journey. Market conditions can fluctuate, and investments can go up or down in value. It’s essential to remain patient, avoid emotional decisions, and stay focused on your long-term goals. Additionally, consider consulting with an investment advisor or certified financial planner for personalized investment guidance and financial planning based on your unique financial situation and objectives.

7. Address Financial Challenges:

Life is full of financial challenges, from unexpected medical bills to job loss. Think about and understand strategies for dealing with unexpected expenses, job loss, or economic downturns. Building resilience involves creating a financial buffer, staying adaptable, and maintaining a positive attitude. Good financial habits and preparedness are things you can develop. Remember that setbacks are part of the financial journey, and with the right strategies, you can recover from financial setbacks and thrive.

Tips for recovering from financial setbacks can help prepare you for the unexpected. Here’s a list of 5 unexpected financial challenges and suggestions on how to address each one:

Medical Emergency:

Challenge: Sudden medical expenses can be financially draining. Even with insurance, co-pays, deductibles, and out-of-pocket costs can add up.

Addressing the Challenge: Consider creating an emergency fund to cover medical expenses not covered by insurance. Negotiate medical bills, set up payment plans, and explore financial assistance programs if necessary. Review your health insurance policy to understand coverage and options for preventive care.

Job Loss:

Challenge: Losing your job unexpectedly can lead to a loss of income, making it challenging to meet financial obligations.

Addressing the Challenge: Immediately assess your financial situation, cut unnecessary expenses, and create a budget to manage your remaining funds. Apply for unemployment benefits if eligible, and actively search for new job opportunities. Consider freelancing, part-time work, or gig economy jobs as temporary income sources.

Car Repairs:

Challenge: Unexpected car repairs can be costly and disrupt your budget.

Addressing the Challenge: Build an emergency fund to cover unexpected vehicle maintenance. Regularly maintain your car to prevent major issues. If repairs are necessary, get multiple quotes and consider financing options if the cost is substantial.

Natural Disasters:

Challenge: Natural disasters like hurricanes, floods, or wildfires can damage property and result in significant financial losses.

Addressing the Challenge: Ensure you have appropriate insurance coverage, including homeowners’ or renters’ insurance and flood insurance if applicable. Create an emergency evacuation plan and store important documents in a secure location. Establish an emergency fund to cover immediate expenses like temporary housing and food.

Legal Issues:

Challenge: Unexpected legal issues, such as a divorce, lawsuit or legal fees, can be financially burdensome.

Addressing the Challenge: Consult with an attorney for legal advice and explore options for dispute resolution. If facing litigation, consider mediation or settlements to avoid costly court battles. Review your insurance policies for coverage related to legal matters.

In general, proactive financial planning can help mitigate the impact of unexpected financial challenges. Building an emergency fund, having adequate insurance coverage, and creating a budget can provide a financial safety net and help you navigate unexpected expenses more effectively.

8. Continuously Improve Financial Literacy:

Financial literacy is crucial for gaining confidence in your financial decisions. Financial literacy is an ongoing journey. Great news! You have started your financial literacy journey by reading this article. Explore resources from reputable sources, read personal finance books, enroll in online courses, and stay informed about financial news and trends. The more you learn, the better equipped you’ll be to make informed decisions and build your financial literacy.

9. Seek Professional Guidance:

Financial advisors or planners can offer personalized guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, navigate complex financial decisions, and stay on track for the long term. You may also want to talk with an investment advisor for specific investment advice, an attorney, insurance broker, or others who are trusted advisors.

10. Explore Additional Resources:

Take advantage of the wealth of resources available to support your financial journey. Consider reading books on personal finance, attending financial workshops or seminars, and seeking guidance from financial professionals and financial advisors. The Consumer Financial Protection Bureau has resources and guides for savings goals, credit card debt, retirement plans, and more for overall financial health. The more you immerse yourself in financial education, the more empowered you become in managing your money effectively and creating your own financial well-being.

Conclusion

In conclusion, financial confidence is not out of reach; it is achievable through knowledge and proactive financial management. By increasing your financial literacy, understanding financial wellness, setting clear goals, practicing good money habits, and seeking professional guidance when needed, you can take control of your financial life.

Financial wellness goes beyond numbers; it’s about achieving a sense of financial security and well-being. It means having the freedom to make choices that align with your values and long-term goals, reducing financial stress, and enjoying peace of mind.

Confidence in managing your finances comes with practice and knowledge. Embrace a growth mindset, continuously learn, and apply what you have learned in your financial life. As your confidence grows, you’ll make more informed decisions and achieve greater financial success.

Steps You Can Take Immediately

- Explore additional resources on our website, including financial literacy guides and financial wellness checklists.

- Contact us for more information on how we can help you on your journey to financial literacy and financial wellness.

Remember, understanding financial literacy and financial wellness is an ongoing process, and the choices you make today will shape your financial well-being tomorrow. Start your journey towards financial confidence now, and take control of your financial future.