Navigating a major life transition is akin to finding your way through a dense forest, where it’s as crucial to see the individual trees—each decision and challenge—as it is to view the forest as a whole—the broader journey of change. This perspective allows you to manage the details of your transitions while keeping sight of the larger picture, ensuring that each step is aligned with your overall life goals and values. With this approach, you can move through the complexities of change with a clear vision, making informed choices that contribute to a successful journey through life’s transformative phases.

Whether you’re facing a career change, entering retirement, or adapting to a new family dynamic, these pivotal moments are filled with a mix of excitement, uncertainty, and sometimes, apprehension. These transitions don’t just impact individuals; they ripple through families and communities, reshaping lives in profound ways.

Our goal in this discussion is not just to acknowledge these challenges but to offer a comprehensive guide—a beacon, if you will—that illuminates the path forward, enabling you to successfully navigate these significant life changes with confidence, resilience, and a positive outlook.

Understanding Major Life Transitions

At their core, major life events represent significant shifts in our personal, social, or professional lives. They are the junctures where our daily routines, relationships, and even our self-identity undergo transformation. These new circumstances, whether planned or unexpected, often bring a whirlwind of emotions. Understanding that these transitions are a universal part of the human journey is crucial. It’s normal part of change to feel a sense of loss for what’s being left behind, yet there’s also potential for growth and new opportunities.

Types of Major Life Events

Transitions in life come in various forms, for example:

Personal: These life transitions include milestones like marriage, which involves merging two lives and possibly two families, or the birth of a child and the journey into parenthood, demanding new levels of responsibility and emotional depth.

Professional: Changing careers, job loss, or retiring not only impacts one’s financial status but also their sense of identity and daily structure.

Emotional: Losing a loved one or going through a divorce are profound emotional upheavals, often effecting one’s mental health requiring a complete restructuring of one’s personal life and social support system.

Life transitions also have various temporal aspects. Life transitions, whether temporary or permanent, bring with them unique sets of challenges and opportunities for growth. Temporary transitions, such as a career sabbatical or parental leave, have a definitive end point, whereas permanent transitions, like retirement or losing a loved one, mark a more lasting change in life’s trajectory.

Temporary: For example, a life transition such as a career sabbatical offers a break from the usual work environment and can be a time for personal development or exploring new interests. However, it also requires planning for a return to the workforce, which might involve keeping skills up-to-date or staying connected with professional networks.

Permanent: Retirement is an example of a permanent transition, marking the end of a regular work life and the beginning of a new phase with different routines and priorities. It requires a fundamental reshaping of daily structure, financial planning, and often, a redefinition of personal identity.

Fluid Transitions: When permanent becomes temporary or temporary becomes permanent.

Sometimes, what is anticipated as a permanent transition, like retirement, can unexpectedly become temporary due to unforeseen circumstances such as a change in financial position. This type of fluid transition requires a flexible mindset and adaptive strategies. It’s important to stay informed about your financial health and have contingency plans in place.

Each combination or type of transition requires a tailored approach in terms of preparation, adaptation, and emotional processing. Acknowledging the nature of the transition is the first step in effectively managing its impact and embracing the new opportunities it presents.

Embracing Change with Resilience

Resilience in the face of change is not a fixed trait but a skill that can be cultivated through planning and practice. This skill becomes especially crucial during life transitions, where adaptability and emotional strength are key. It involves preparing for the ‘what ifs’ of life – considering possible scenarios and making early preparations for them. For instance, someone approaching retirement might start by envisioning various scenarios: What if my savings aren’t as robust as I hoped? What if I decide to work part-time or pursue a new hobby? By exploring these possibilities and creating contingency plans, they’re not only preparing financially but also mentally and emotionally for this significant life change. This proactive approach not only helps in managing the immediate impacts of change but also aids in the long-term process of adjustment and growth. Learning from those who have navigated similar transitions can offer invaluable insights, showing us that while these journeys may be challenging, they are also replete with opportunities for self-discovery and personal development. By contemplating different outcomes and practicing resilience in smaller challenges, we build a resilience toolkit that equips us to cope more effectively when faced with transformative events.

Strategies for Navigating Major Life Transitions

Transitions in life can create feelings of excitement and anticipation for a new life opportunity, but also of stress, anxiety, and fear. Everyone has different coping mechanisms. Successfully managing life transitions requires a comprehensive and proactive approach:

- Effective Communication: Open and honest communication is vital, particularly during transitions in life that impact family members, business partners, or other groups. It ensures that all voices are heard and is vital for mutual understanding and support.

- Support Networks: Leveraging professional counseling, peer support groups, or even online communities or therapy can provide invaluable perspectives and advice during a life transition. Support can be found through your high school or college friends, your church or religious family, or professional services from your healthcare providers.

- Goal Setting: Establishing clear, achievable short and long-term goals can provide a roadmap, helping to navigate a life transition with purpose and direction.

- Self-Care: Self care is important to improving your mental health and well being. Prioritizing your physical, mental, and emotional health is essential for maintaining balance and resilience during transitions in life. Get a good night’s sleep. Maintain good eating habits. Practice breathing exercises. Develop coping strategies. These are a few ways to ensure that you’re in the best position to handle the challenges ahead.

- Structured Planning: Having a plan for practical matters, like financial arrangements in retirement or job search strategies after a career change, is essential. Those who successfully navigate new circumstances spend less time struggling with uncertainty and more time taking action when they have a plan and a process.

- Proactive Planning & Envisioning Potential Futures: Not every transition in life can be anticipated. However, to the extent you can, actively contemplate various ‘what if’ scenarios and potential outcomes of your transition. This could involve imagining both best-case and challenging situations, and then developing strategies to manage them. For example, if you’re transitioning to a new career, envision how this change will impact your daily life, finances, and personal relationships. Plan for how you’ll adapt to a new work culture, update skills, or balance work-life dynamics. This proactive planning not only prepares you for different eventualities but also builds confidence and agility, allowing you to navigate your transition more smoothly and effectively.

Financial Planning During Transitions: Maximizing Your Resources

Effective financial planning when you experience a major life event is crucial and involves a deeper understanding of the various financial levers at your disposal. It’s about more than just budgeting; it’s about reassessing financial goals, understanding the impact of these changes on your financial health, and making informed decisions. This might involve reevaluating investment strategies, exploring insurance options, or adjusting retirement plans.

Knowing what these levers are, and more importantly, understanding when and how to utilize them, can significantly impact the optimization of your resources, both in the short and long term.

Identifying Financial Levers: First, identify all available financial options. These can include savings, investments, retirement funds, real estate, and other assets. Each of these levers has unique characteristics and rules of engagement.

Strategic Execution of Resources: Knowing when to execute each financial lever is key. For instance, tapping into retirement savings may be suitable in some scenarios but could lead to substantial penalties or tax implications in others. Alternatively, liquidating investments might be favorable in a bull market but not during a downturn.

Balancing Short-Term Needs and Long-Term Goals: It’s vital to balance immediate financial needs with long-term objectives. Short-term strategies might involve adjusting your budget to reduce expenses or temporarily halting contributions to retirement accounts. Long-term strategies could include restructuring investment portfolios for better growth or diversification to protect against market volatility.

Understanding Impacts and Avoiding Unintended Consequences: Each financial decision should be made with an understanding of its potential impact. For example, withdrawing from a 401(k) early might provide immediate cash flow but can significantly diminish your retirement nest egg due to early withdrawal penalties and lost compounding interest. Similarly, selling property for quick cash might solve short-term liquidity issues but can impact your long-term financial stability and tax obligations.

Seeking Professional Advice: Given the complexity of financial planning, especially during transitions, consulting with financial and investment advisors is highly recommended. They can provide personalized advice based on your unique financial situation, helping you to understand the implications of each decision and guiding you in strategically utilizing your financial resources.

Successful financial planning during life transitions requires a careful evaluation of your financial tools, an understanding of the right timing to utilize them, and a strategic approach to balancing immediate needs with future goals. This careful planning helps in minimizing negative unintended consequences and ensures a more stable financial future.

Legal and Estate Planning

Getting married, experiencing illness, significant loss, or becoming a parent are transitions in life where legal and estate planning are critical, particularly during transitions involving a family member or retirement. Having a will, establishing trusts, and understanding powers of attorney can safeguard your assets and ensure that your wishes are honored. These steps provide peace of mind, not just for you but also for your loved ones.

Legal and estate planning (including legacy planning) is an integral component of comprehensive financial planning, playing a crucial role in ensuring that your wishes are executed as intended. This process involves more than just drafting a will; it encompasses a range of legal considerations and documents that, if not properly handled, could override your desires.

Integration with Financial Planning: Estate planning should align with your financial goals and plans. It involves decisions about asset distribution, which should reflect your financial strategy. This alignment ensures that your estate is managed and distributed in a way that aligns with your overall financial objectives.

Navigating Legal Complexities: The legal landscape of estate planning is complex, with various laws and regulations that can impact the execution of your wishes. For instance, without a legally sound will or trust, state laws may dictate how your assets are distributed, potentially in ways that contradict your intentions. Similarly, not designating beneficiaries or not updating them can lead to unintended heirs receiving your assets.

Comprehensive Estate Planning Documents: A well-structured estate plan typically includes a will, trusts (if appropriate), power of attorney, healthcare directives, and beneficiary designations. Each of these documents serves a specific purpose and collectively ensures that all aspects of your estate are covered. For example, while a will outlines how you wish to distribute your assets, a power of attorney appoints someone to manage your affairs if you’re unable to do so.

Easing the Burden on Loved Ones: By having a comprehensive set of estate planning documents (including a death binder), you not only ensure that your wishes are carried out, but you also provide a great service to your family. In the event of your passing or incapacity, these documents offer clear guidance on managing your affairs, reducing the emotional and administrative burden on your loved ones during a difficult time.

Effective legal and estate planning is crucial for making sure your wishes are honored after you’re gone. It ties directly into your overall financial plan and requires careful consideration of various legal aspects. By ensuring that your estate plan is thorough and up-to-date, you provide peace of mind for yourself and a priceless gift of clarity and ease to your family.

Embracing Change as an Opportunity for Growth

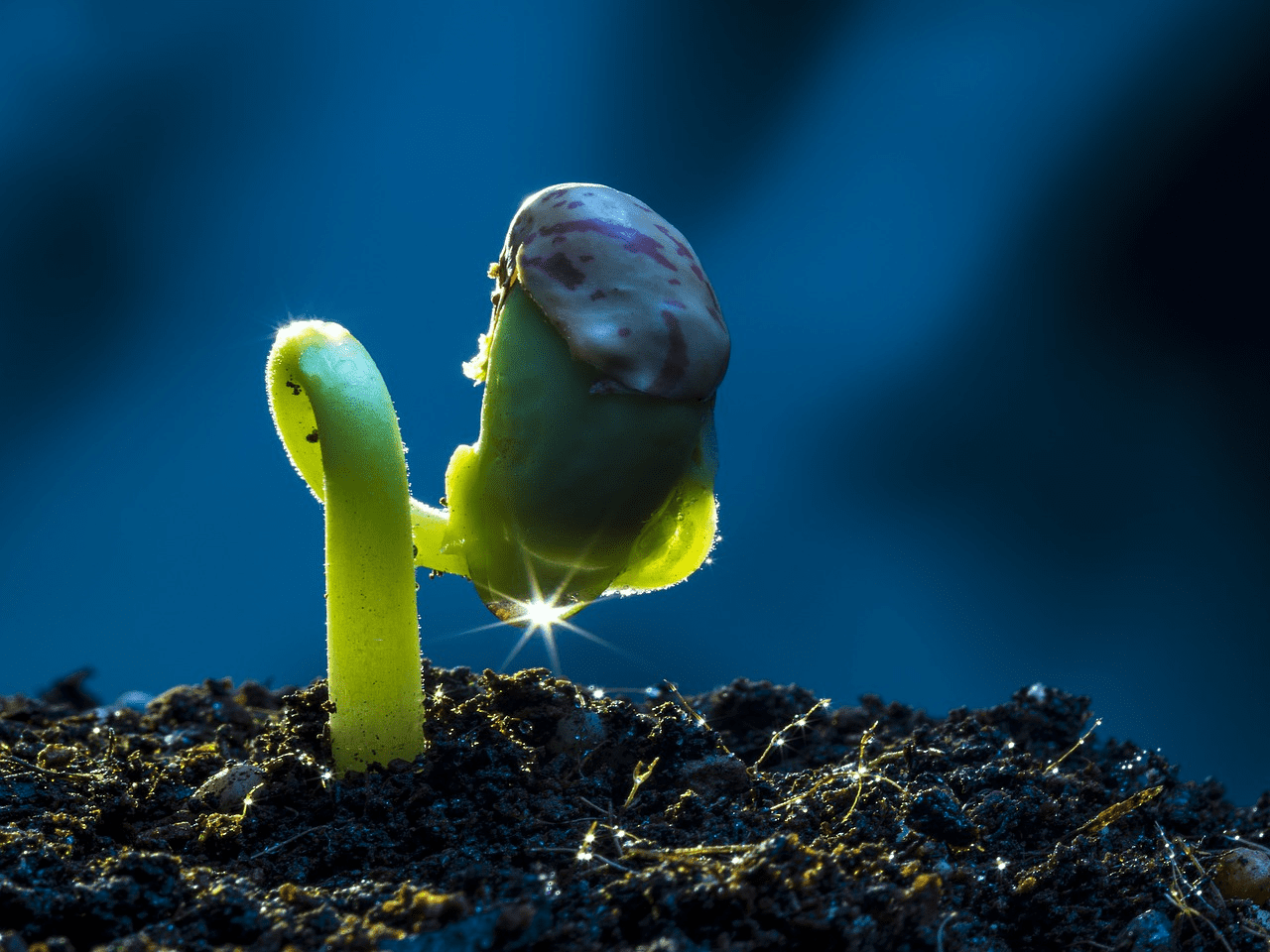

Every major life transition, even those that are challenging, carry the seed of an opportunity for personal development. These changes often prompt us to reevaluate our priorities, reflect on our values, and explore new passions. By embracing these transitions as pathways to growth, we can uncover hidden strengths and discover new dimensions of ourselves.

A Trusted Partner

In the journey of life, transitions are inevitable. But with the right guidance and support, they can be navigated with confidence and grace. Find a trusted friend or partner to encourage you and to help you achieve goals. Take the first step in transforming your life transitions from periods of uncertainty into opportunities for fulfillment and growth. Life awaits, and with the right support, your next chapter can be a remarkable story of triumph and personal growth.